The “Medicare donut hole” is a term used to describe a coverage gap in Medicare Part D prescription drug plans. This coverage gap occurs after a certain amount of money has been spent on prescription drugs and before catastrophic coverage kicks in. The term “donut hole” comes from the fact that it creates a hole in the coverage that resembles the shape of a donut. There are four stages to Medicare Part D which are important to understand.

Donut Hole for Medicare Part D

The Medicare Part D prescription drug plan was introduced in 2006 to help seniors and people with disabilities pay for prescription medications. The plan works by offering coverage for prescription drugs up to a certain limit. Once the limit is reached, the beneficiary is responsible for paying a larger portion of the cost of their medications until they reach the catastrophic coverage threshold.

The coverage gap, or donut hole, is reached when a beneficiary’s total drug costs (both the amount paid by the plan and the amount paid out of pocket) reach a certain amount, which is determined each year by the federal government. Once the beneficiary reaches this limit, they become responsible for a larger portion of their drug costs until they reach the catastrophic coverage threshold.

What was the Medicare Donut Hole 2022?

For example, in 2022, the coverage gap starts when a beneficiary’s total drug costs reach $4,430. At this point, the beneficiary is responsible for paying 25% of the cost of brand-name drugs and 25% of the cost of generic drugs until their total out-of-pocket costs reach $7,050. Once this threshold is reached, the beneficiary enters the catastrophic coverage phase, and they pay only a small copayment or coinsurance for their drugs for the rest of the year.

What is the Medicare Donut Hole 2023?

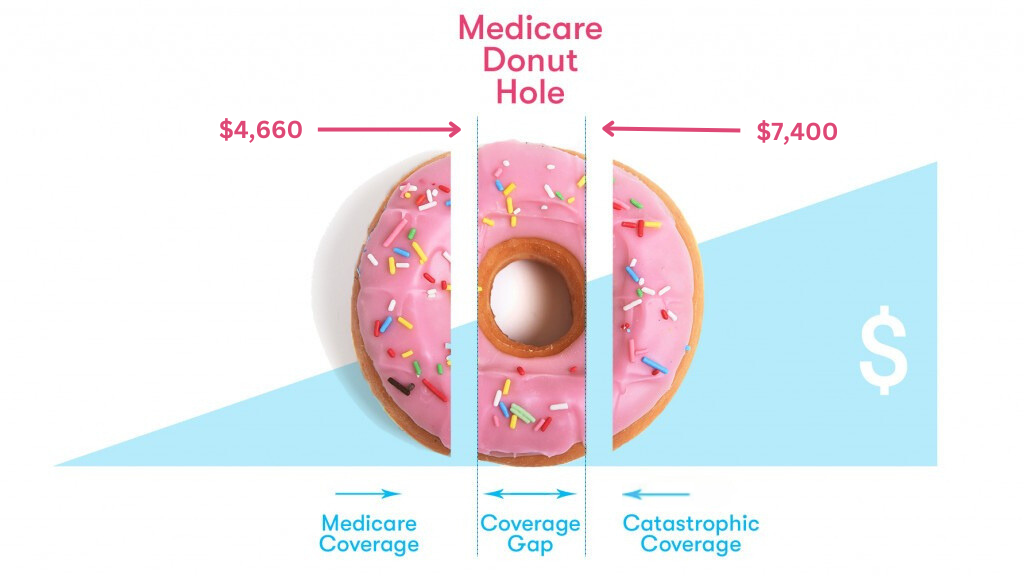

While the 2022 Medicare donut hole started at $4,430, the 2023 Medicare coverage gap starts once a beneficiary’s total drug costs reach $4,660. Once entering the 2023 Medicare donut hole, a beneficiary is responsible for 25% of the total drug costs, until they reach the catastrophic coverage phase. The catastrophic coverage phase begins in 2023 once a beneficiary reaches $7,400 in out-of-pocket expenses. Once they reach this phase they will pay 5% of the cost for each of their drugs, or $4.15 for generics and $10.35 for brand name drugs whichever is greater.

The Medicare donut hole can be a significant financial burden for Medicare beneficiaries, especially those with high prescription drug costs. It can also create a gap in medication coverage that can lead to negative health outcomes if beneficiaries cannot afford to pay for their medications.

There are several ways to avoid falling into the coverage gap. One way is to choose a Medicare Part D plan with a coverage gap that provides additional coverage or discounts during the gap period. Another option is to use generic medications whenever possible, as these are generally less expensive than brand-name drugs.

What is Extra Help from Medicare?

For those who cannot avoid the coverage gap, there are programs available to help. The Medicare Extra Help program provides financial assistance to low-income beneficiaries to help them pay for their prescription drugs. There are also state-based programs that can help with the cost of prescription drugs for those who do not qualify for Medicare Extra Help.

In conclusion, the Medicare donut hole is a coverage gap that all beneficiaries of Medicare should be aware of. The coverage gap can be a significant financial burden for beneficiaries, but there are ways to avoid it or get help with the cost of prescription drugs. While efforts have been made to close the coverage gap, it still exists today, and beneficiaries must be aware of its impact on their healthcare costs. Speaking with an insurance agency in your area can help to better inform your specific coverage options. The best way to understand how the Medicare donut hole affects your individual needs as a beneficiary.